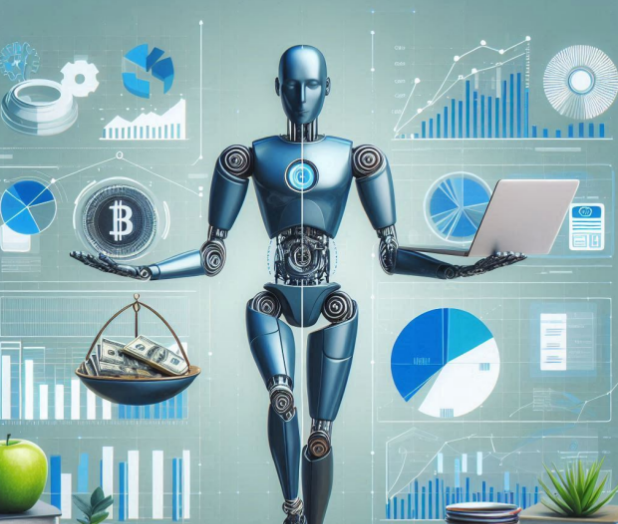

Robo-advisors, the brainchild of personal financial manager in recent times; are set to revolutionize the face of a financial advisor. With algorithms that manage investments and give financial advice with little or no human intervention, digital platforms in this manner change the faces of investors in gazing through financial markets. With time as we enter the future, it is important that one knows to what extent automation should be allowed with human insight into finance. Thus, this article seeks to demystify the rapidly changing landscape of robo-advisors in which challenges and opportunities of combining technology and human expertise have been discussed for better financial outcomes.

Understanding Robo Advisors

Robo-advisory is an online type of investment management platform that relies on algorithms to take investment decisions automatically. In this type, the risk tolerance of a person, financial goals, and time horizon are evaluated to tailor a portfolio. Essentially, such institutions rely on ETFs, among other low-cost investment products, for cost cutting and increasing diversification in portfolios. According to Statista, the assets under management (AUM) of robo-advisors in the United States is projected to increase to $2.56 trillion by 2027 with the increasing number of users of this technology.

The main reasons why robo-advisors are so popular is due to their ease of use and low cost. Most the platforms have relatively low fees like Betterment and Wealthfront who charge annual management fees at 0.25% of AUM. Compared with the traditional financial advisors who typically require between 1% and 2%, the savings become quite sizeable for small investors.

The Use of Automation in Finance

There are various advantages that result from automation in financial management. For instance, automatic robo-advisors can continuously monitor markets, rebalance portfolios, and find ways to enhance tax strategies. It would be an automated robo-advisor that performs a strategy known as tax-loss harvesting, wherein investments are sold at a loss to offset capital gains. The application may be able to improve long-term return by preventing taxable income from growing with the consistency that might not otherwise happen if it is being managed by a human advisor.

Robo-advisors also help prevent emotional biases common causes of losses to the individual investor. Some of these psychological pushers include selling at the bottom and buying at the top. The skill to avoid these pitfalls greatly enhances the performance of the portfolio. According to Vanguard, sticking to a disciplined investment strategy means adding 3% net returns each year.

The Human Element Where Robo-Advisors Fall Short

Indeed, there are many benefits to automation, and robo advisors don't horn all the limitations that a human advisor alone can offer. Such clients who require a complex financial situation-estate planning, tax-efficient wealth transfer, or retirement income strategies require the input of a human advisor. Only a human advisor knows what goes on in the personal life, wills, and goals of their clients and how to mitigate obstacles, which makes his or her advice geared towards an individual rather than the generic algorithm given for a client.

Another essential aspect of financial planning is trust. In most cases, when big financial decisions are made, there is still a preference for face-to-face communication for most Vanguard's clients. It states that a study proved that clients who work with a human advisor come with higher rates of satisfaction and security of the result- even if the financial result has been the same as that produced by a robo-advisor. In addition, robo-advisors breakdown under uncertainty in markets. Usually, an investor is looking for solace and comfort from a human being that can elaborate the logic behind the said decision under uncertain markets. Where the robo advisor will tell you to hold, the human advisor will soothe your psychological nerves that will make you panic sell or even more ridiculous, decision-making.

Hybrid Model Where Technology Meets Human Ingenuity

The future of robo-advisors is very much going to be about a hybrid approach that will bring together the best benefits of automation and human insight. As a matter of fact, nowadays many large financial companies already operate hybrid platforms that unite human financial advisory access with the robo-advisory service, as is demonstrated in the Charles Schwab and Vanguard examples. Such services are more expensive but much cheaper than traditional advisor fees. One of the very good advantages of the hybrid model is its flexibility. Hybrid robo-advisory platforms are expected to reach an estimated compound annual growth rate of 20% between 2020 and 2025-to make it one of the fastest-growing segments in the space of the financial technology, as per Deloitte.

Future Outlooks of the Robo-Advisors and Human Intuition

The robo-advisors' future vision will be far brighter with the advancement in artificial intelligence. Their scope of capability is bound to be much more as AI can comprehend an enormous amount of data, which includes real-time market trends, economic indicators, and the behaviors of clients to make high-fidelity investment recommendations. Its machine learning will enable a robo-advisor to learn from past decisions and advance its strategies over time. It could use sentiment analysis to build AI-powered robo-advisors, thus measuring investor emotions for an even more personalized experience. Advisors could provide highly personal advice to their clients based on the state of emotions, risk-level tolerance, and behavior associated with financial matters.

Their future lies in finding the right balance of artificial intellect and human insight. That is, while investment management becomes very cost-efficient and effective in terms of machines, there is the added comfort and personalized advice from human advisors that no machine can exceed. The hybrid model will be front and center in emerging trends in personal finance. With AI and automation under development, robo-advisors will keep being the spearhead for investment management but cannot lose that human touch necessary for trust and good coaching on holistic wealth.

Challenges and Ethical Issues

High-level AI promises much but has a downside, bigger automation issues. Some of the key issues raised include no transparency about what an algorithm is producing such as not be clear to clients what their portfolios are doing hence creating a culture of mistrust. On the other hand, robo-advisors may increase risk mainly because they will rely exclusively on historical data that may fail in anticipating future market conditions. Therefore, ethical issues emerge, particularly with respect to private data. Robo-advisors deal with vast amounts of personal financial information, which calls for maximum security. Cybercrime in finance is increasing continuously and so the industry must focus on maintaining proper security within the system to protect user data.