Economic downturns, while inevitable, offer crucial lessons for effective financial crisis management. By examining past financial crises, we can uncover strategies that have proven successful in mitigating the impacts of economic downturns. These lessons are particularly relevant today as we navigate the complexities of global markets and anticipate future challenges.

Historical Context

The Great Depression of the 1930s, the 1997 Asian Financial Crisis, and the 2008 Global Financial Crisis are seminal events in economic history. Each crisis had unique causes and consequences, yet they share common themes that provide valuable insights.

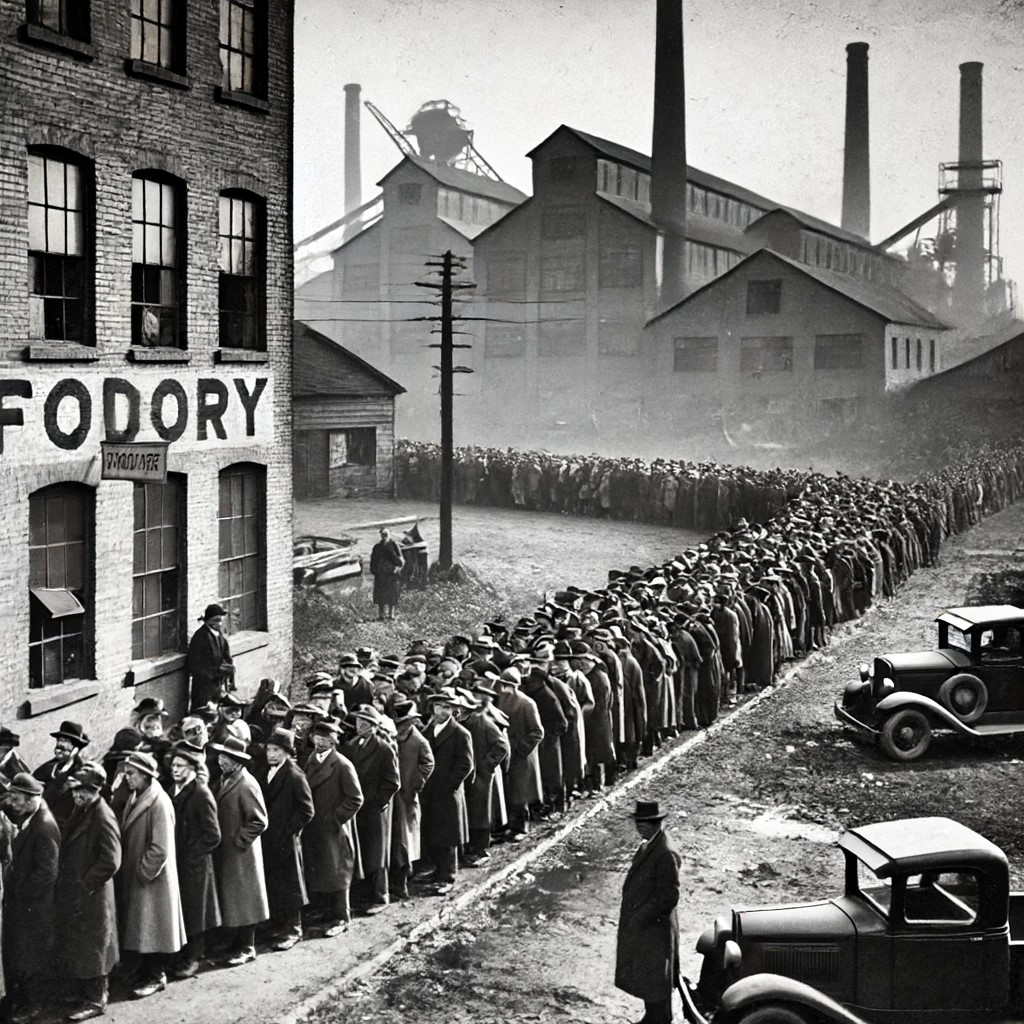

During the Great Depression, the world saw unprecedented unemployment and deflation. Governments learned the importance of fiscal and monetary intervention. The establishment of institutions like the Federal Deposit Insurance Corporation (FDIC) in the United States helped restore trust in the banking system.

The 1997 Asian Financial Crisis highlighted the dangers of excessive borrowing and currency mismatches. Countries affected, like Thailand and South Korea, implemented stringent financial regulations and reforms to stabilize their economies. The International Monetary Fund (IMF) played a significant role in providing financial assistance and advocating for economic restructuring.

The 2008 Global Financial Crisis, triggered by the collapse of Lehman Brothers, exposed the vulnerabilities of the global financial system. It underscored the importance of robust risk management practices and the need for better regulation of financial markets. The Dodd-Frank Act in the United States aimed to prevent such a crisis by increasing transparency and accountability in the financial sector.

Current Trends

In today's interconnected world, financial crises can have swift and far-reaching impacts. The COVID-19 pandemic is a recent example, causing global economic disruption. Governments responded with unprecedented fiscal stimulus packages and central banks employed unconventional monetary policies, such as quantitative easing, to support economies. These measures have highlighted the importance of agile and coordinated responses to crises.

Digital transformation is another significant trend. The rise of fintech and digital currencies is reshaping financial systems. Blockchain technology, for instance, promises to enhance transparency and reduce fraud. However, it also introduces new risks that need to be managed effectively.

Future Predictions

Looking ahead, several predictions can be made about financial crisis management. Firstly, we can expect an increased reliance on technology. Artificial intelligence (AI) and big data analytics will play a crucial role in identifying and mitigating risks. Real-time monitoring and predictive analytics will enable faster and more effective responses to emerging threats.

Secondly, regulatory frameworks will continue to evolve. Governments and international organizations will likely implement stricter regulations to address systemic risks and ensure financial stability. Cross-border cooperation will be essential to manage global financial interconnectedness.

In conclusion, financial crisis management is an ever-evolving field. By learning from past economic downturns, we can better prepare for future challenges. The integration of technology, evolving regulatory landscapes, and a focus on sustainability will shape the future of financial crisis management. As we navigate these trends, the lessons from history remain invaluable, reminding us of the importance of resilience, adaptability, and proactive measures in safeguarding economic stability.