Microservices are transforming how financial institutions build, deploy and scale applications. As financial companies are adopting more digital solutions, there is a desire for agile, modular and efficient software architecture. Using microservices, financial organizations can develop independent, modular services from a large and complex application and develop them and scale them independently. This means financial services that are responsive, hence competitive with high-changing demands from customers and ever-evolving and dynamic regulatory requirements. This article takes an in-depth look into microservices, their applicability in empowering financial innovation, and benefits toward the finance industry.

What are Microservices?

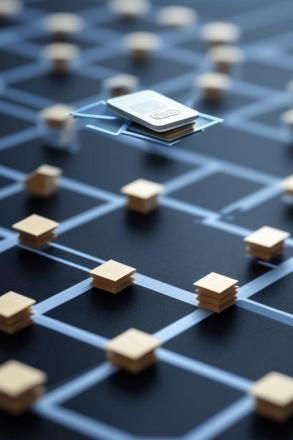

Microservices means an architecture in which applications are composed by many small, independent services that work together to achieve the overall purpose of the application. In contrast to a traditional, monolithic architecture in which all components are tightly interconnected, in a microservices architecture, any service could run independently. For example, transactions for a banking application could be handled by one service, another handle the customer information, and so on for loan applications. Each microservice can be developed, deployed and scaled independently. This modular approach has made it possible for companies like Netflix and Amazon to deliver complex, high-demand services with great efficiency.

Why Microservices are Important for Financial Services?

Financial services operate in a highly regulated business environment that is competitive. They need to process vast amounts of data, provide hassle-free experiences to customers, and adapt quickly to changes in regulatory provisions. And this is all because of the following advantages from microservices:

- Scalability: Microservices allow the scalability of services rather than that of an application as a whole. For instance, in a bank's application, during peak hours, only the payment processing service needs to be scaled and not the entire application.

- Agility and Quicker Innovation: Microservices allow for quicker rollout of updates and innovations. Developers can work independently on services without affecting other services, which is very critical while rolling out new products or adapting to regulatory updates.

- Reliability: Microservices create an application that is more resilient in isolation. Therefore, one failing service will not bring down the whole system. For example, if a loan-processing service crashes, other services, such as checking accounts or transactions, are still running.

Advantages of Using Microservices in Financial Innovation

- Rich Customer Experience: Today, customers expect personalized, seamless, and secure banking. The microservices architecture allows companies to build tailored services for such high-quality experience; for example, a financial institution may develop a microservice in the customer recommendations that makes suggestions of savings or investment products through spending habits and financial goals. Deloitte study reports 85% of financial services firms believe that the customer experience is the primary competitive differentiator. With microservices, banks are in a position to rapidly deploy enhancements that directly affect user experience thereby enabling them to be able to meet and beat the expectations of customers.

- Faster Product Development and Time-to-Market: They are modular; they enable teams to focus on small components while allowing considerable speeding up of development times. This agile approach towards development also allows banks to respond directly to market needs or regulatory changes and to customer demands instantly. An example that you see often is in the rapid deployment of mobile payment features and digital wallet options as the world moves toward cashless transactions. According to McKinsey, microservices improve the frequency of deployment by 20-30% and cut the cycle time of development by more than 50%. This translates into faster time-to-market and quick adaptation capabilities to new opportunities.

- Improved Compliance with Regulations: Strict and dynamic regulatory requirements characterize the financial industry. Service impairment cannot be tolerated by applications when ensuring compliance to such regulations. For example, when new AML requirements need to be inducted throughout the firm, the AML compliance microservice of a bank can be updated independently instead of having to rework the application code as a whole. This flexibility helps banks maintain compliance at the highest levels while preserving the best levels of operational efficiency. A PwC survey found that regulatory compliance is at the top of the list for financial services leaders as part of their technology strategy; indeed, almost 60% of them do. Microservices make compliance more feasible, less costly, and not system intrusive.

Microservices in Financial Applications

- Payment Processing: One of the most popular domains for microservices in finance is payment processing, which facilitates the organization of payment processing for banks by encapsulating this function into a separate service that may be scaled up for peak demand such as on Black Friday or Cyber Monday. New payment methods, including cryptocurrency payments, are also provided without necessarily carrying out an entire application overhaul.

- Fraud Detection and Prevention: This can be done by linking AI and ML models directly to the application, hence its ability to detect fraud in real-time. A fraud-detecting microservice can scan data from various sources like the patterns of transactions and the locations of devices with a view of identifying suspicious activity immediately. The suspicious transactions will flag in place while the remaining application will not be affected as it waits for its usability determination. For example, JPMorgan Chase adopts a microservices-based model for fraud detection. Adopting this model, they apparently analyze millions of transactions every day with a real-time detection rate to significantly enhance the security level for customers.

- Customer Onboarding and KYC (Know Your Customer): One of the key areas in financial services is the onboarding process, which involves fundamental aspects like KYC checks. The microservices approach makes this even easier for banks to achieve with such ease. A dedicated onboarding microservice could, for instance, speed up the KYC check without compromising on the security, should it be armed with facial recognition, document scanning, and identity verification capabilities. According to Finextra, in a global survey, 73% of financial institutions are investing in digital onboarding technology. Microservices-based onboarding saves time in opening new accounts that would otherwise impact customer satisfaction.

Challenges in the Usage of Microservices in Financial Sector

Microservices have many benefits. However, there are numerous challenges they pose such as:

- Complex Management: Microservices can be related to so many standalone services, which therefore creates complexity and necessitates a highly qualified IT team as well as sophisticated tools.

- Data Security and Privacy: Financial data is usually sensitive, and so, securing that data within a microservices environment requires really strong security protocols as well as frequent audits.

- Inter-Service Communication: Communication across services is actually reliable but can be very tricky to get right at scale. APIs, in addition to performance monitoring, should be used to avoid slowdowns within the system.

- High Upfront Investment: From monolithic to microservices architecture is a costly affair upfront. However, the long-term cost of operations and flexibility make up for this huge one-time investment.

Future of Microservices in Finance

The role of microservices will most likely continue to increase in the financial industry with a quest for digital transformation. The future of financial institutions is to develop and maintain applications that are more responsive, customer centric as in the future there would be greater reliance on microservices over the next few years. Bringing in such emerging technologies as artificial intelligence and blockchain will expand these possibilities, making innovation easier and more adept at paying attention to changing customer needs. Microservices are not an IT mania but a fundamental shift in how financial services function. With more institutions switching to this architecture, one can expect faster, more secure financial products-as well as more innovative types of financial products-aimed at the needs and wants of the modern customer.